Now more than ever, financial services institutions need to move from legacy operational processes. Followed by competing with the fast-moving digital world, by putting a digital customer experience at the centre of their digital transformation game.

In this article, we talk about why agile is key to Financial Institutions (FIs) successful digital transformation journey.

Current Financial Services Industry Scenario

The rising demand of digital and convenience in financial services requires huge investments in IT applications. In order to make processes simpler and efficient. The growing regulatory changes, risk management requirements and the diversity of channels have risen the need for FIs to integrate new and innovative technologies in their legacy processes.

While financial institutions understand the need to adopt agile methods to counter such challenges, their existing processes, legacy systems, and organisational structures stand in the way of adoption. They take an approach best suited to their context. But the lack of a common vision ‘Why agile?’ and ‘what it means to adopt the agile way of working’ leads them to fail to deliver the business value they anticipated.

So, Why Agile?

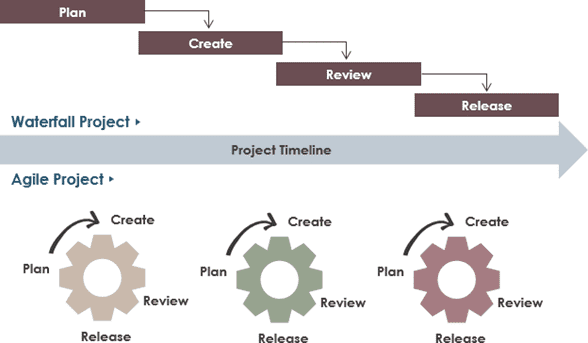

Traditional software development processes are based on linear principles. Where a team must plan, schedule, and complete all the activities for any given phase before starting the next phase. Problems with traditional all-in-one delivery models in some of the key areas (listed below) forced professionals to develop agile and lean methodology.

RISK & UNCERTAINTY MANAGEMENT

Traditional methods of product development can be inefficient at times in dealing with risks and uncertainty. Steve McConnell’s “Cone of Uncertainty” (Demystifying the Black Art, © 2006 Steven C. McConnell) cleverly captures the initial ranges of uncertainty at different points in a Waterfall driven project. During the requirement gathering phase of a project. The range of the estimation can be between 60 percent to 160 percent of the original estimate. That is, if a project is supposed to take 20 weeks, it could take anywhere between 12 to 32 weeks.

POOR VISIBILITY / USER FEEDBACK

Traditional product development does not allow for client or end-user collaboration. Product designers and developers consult the client only through a series of interviews. Followed by proceeding through the sequential process with a type of tunnel vision. Lack of feedback loops often results in client dissatisfaction and frustration.

ALL-IN-ONE DELIVERY

Under traditional project management approaches, the deliverables are released to the customer only after the completion of all 5 stages i.e., all-in-one delivery as oppose to the small chunks in incremental releases i.e., Minimum Viable Product (MVP) approach.

ADAPTABILITY TO THE CHANGING REQUIREMENTS

Waterfall is normally seen as a heavy-weight and big design upfront (BDUF) approach to project management. It does not have any checkpoints or course correction mechanism, and most of the development is carried through without taking changing conditions into consideration.

Image source: https://www.visual-paradigm.com/scrum/classical-vs-agile-project-management/

Numerous studies have found that Agile driven approach have a 3 times better success rate in delivering complex projects, especially new product development ones where requirements are intangible, volatile and scope is a variable quantity. Agile methodology offers a “lightweight” alternative to the traditional development process and focuses on delivering value to the customers frequently (“iteratively”) and in small “increments”.

If we consider using Agile development, we should ask ourselves one simple question:

“Will agile development help us be more successful in the industry?” Let us understand more on the word “Success”.

The most popular definition of “Success” is delivering a project on time, within the budget and according to specification. But sometimes a project can be challenged even if it delivers millions of dollars in revenue. There is always more to the success than just delivering the project on time.

An organisation is only successful when the team working for the project is successful. A team is only successful, when the individuals working in the team are motivated and believe, together, they can meet the goal. Organisational success is often neglected by the software teams in favour of the more easily achieved technical and personal success. Therefore, a business owner always plays the key role in a project. The business owner will monitor the business functions developed by the software team as well as the cost.

A Look At Agile Manifesto Through The Financial Services Industry Lens

Although the agile manifesto was written to support software practitioners. It serves as guidance for financial institutions to emphasis rapid decision making, collaboration, and customer satisfaction.

Of the twelve agile principles, there are five that are particularly relevant for the financial industry.

Our Highest Priority Is To Satisfy The Customer Through Early And Continuous Delivery Of Valuable Software

For financial services, the important phrase here is “early and continuous delivery”. In Agile, project execution is done through several iterations and value gets delivered through incremental releases. The team completes the several iterations, each with its own cycle of planning, execution, monitoring/control, and closure. Each completed iteration has feedback loop and outcomes are fed back into the planning of the next and future project iterations. This is one of the major differences between Traditional approaches and Agile.Agile methodology expects variations and variance in scope, cost, and time as an inherited nature of projects. In contrast, Traditional project management techniques assumes all requirements are well understood and defined. Therefore, executing projects using Agile approach could enable financial institutions to better cater to the needs of the customer, as per changing market conditions.

Welcome Changing Requirements, Even Late In Development. Agile Processes Harness Change For The Customer’s Competitive Advantage

For the financial industry, this principle implies that they should effectively and efficiently handle any change in the requirement. For example, in the financial world there are always chances of a sudden change in regulatory-compliance requirements. Under such circumstances, it becomes very difficult for tech teams to understand new requirements and correspondingly make changes.The Agile approach addresses this problem by defining high levels, yet focused, scope in the form of user stories that are scheduled to be released with the defined project release plan.

During the initiation phase of a project, the Product Owner creates user stories for the entire project, but only produces detailed supporting documentation for those user stories scheduled for the first couple of iterations. Hence, if the scope changes, the invested time on the scope is minimal and little rework is needed. Furthermore, Agile assumes cost, time and quality are fixed, and only scope can change. At Contemi, our scrum teams only work from the prioritized backlog of requirements that offers the most business value. When a scope change or a new feature is to be added to the project’s scope, it has to be swapped with an item with the same number of story points.

Business People And Developers Must Work Together Daily Throughout The Project

Financial service organisations can enable better decision making if they do not operate in silos. Breaking Silos promotes collaborative development among all team members and the customer to deliver results that reflect the true need of the customer. In Agile, the main tools for enabling close collaboration are used at iteration level. That is in the form of daily stand-up meetings, sprint-demo and retrospective meetings. It enables the technology teams to clearly identify the strategic goals and allows members to systematically monitor processes and match operations with set standards.

Agile Processes Promote Sustainable Development. The Sponsors, Developers And Users Should Be Able To Maintain A Constant Pace Indefinitely

Unlike Traditional software development approaches, the aim of agile is to have a small scope and rapid delivery model while releasing value to the customers incrementally. Agile has emerged with its highly iterative and incremental process, where customer, project team and stakeholders work together in several small self-contained development cycles which yields impressive benefits in the form of increased productivity and inbuilt quality. Improved productivity results from building self-driven teams around motivated individuals, adaptability to change and feedback loop which leads to continuous improvement. Agile emphasizes on communication between all parties rather than processes or plans.

Simplicity – The Art Of Maximising The Amount Of Work Not Done – Is Essential

Financial Institutions can promote simplicity by focusing on strategic, high-value tasks over low-impact work, which will give them most value with quick implementation and frees them to focus on supporting the wider business.

How Agile Can Pay Off

When done successfully, its results can be startling:

Source: Scaled Agile Inc., SAFe, why do Businesses Need SAFe?, 2018

- Agile methods achieve organisational successes by focusing on delivering value and reducing costs.

- Agile methods set expectations early in the project. So, if your project is not going to be an organisational success! You will find out early enough to cancel it before your organisation has spent huge money and time.

- Agile teams increase value by including business experts. Also, by focusing development efforts on the core value that the project provides for the organisation.

- Agile projects release their valuable features first and frequently, which increases the value.

- Agile teams change direction to match the change in business needs in the middle of the project.

- Agile teams communicate quickly, accurately and they make progress even when key individuals are unavailable

- The statistics say, the best agile projects generate only few bugs per month. The regular review of process and continual improvement of code makes the software easier to maintain and enhance over time.

Fintech is booming, and digital financial services (digital wealth, online insurance, online trading etc.) are an integral contributor to that boom. Adopting agile development is one of the ways that legacy players can implement their digital transformation plans successfully. New client onboarding is an obvious example of a need for a flexible and agile approach in business. In order to grow and give a new customer the best possible start. Get onboard with agile as quickly as possible to make this a reality.